Model Oil Portfolio – For the Week Ending July 19, 2019

eResearch is pleased to present its Model Oil Portfolio, comprising quality Canadian oil stocks. [more]

eResearch is pleased to present its Model Oil Portfolio, comprising quality Canadian oil stocks. [more]

eResearch is pleased to present its Top Ten Portfolio, a model portfolio of high-quality stocks listed on the Toronto Stock Exchange. [more]

eResearch is pleased to provide an article by Keith Richards for ValueTrend. Today’s analysis focuses on two uranium stocks and the arbitrage opportunity that often presents itself. [more]

The first cannabis ETF in the world has fallen more than 25% in share price since March 2019, but in contrast, the cannabis market has continued to be a highlight for numerous catalysts. [more]

Curaleaf Holdings announced a US$875 million acquisition that combines the largest public and the largest private multi-state operators in the U.S., which together will now operate 131 dispensary licenses, 68 operational locations, and 20 cultivation sites. [more]

eResearch is pleased to publish our Update Report on Newgioco Group (OTCQB: NWGI), highlighting the Company’s recent doubling in size in their gambling distribution network in Italy, the launch of their second-generation mobile web platform, and the new CFO and independent Board Members. [more]

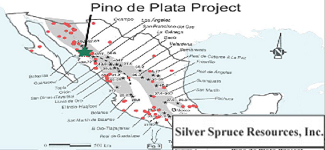

eResearch Corporation is pleased to publish our July 17 Update Report on Silver Spruce Resources, with new updates on its flagship property, the gold-silver Pino de Plata project in Mexico, the sale of Kay Mine, and the pending acquisition of an advanced gold project in Mexico. [more]

The United States Military’s Pentagon is expected to announce the winner of a US$10 billion contract to develop and support the cloud infrastructure behind an artificial intelligence (AI) driven computing network. [more]

J.P. Morgan Chase launched “You Invest Portfolios”, a robo-advisor platform that utilizes algorithms to actively re-balance diversified portfolios of the Company’s ETFs. [more]

eResearch is pleased to provide the Ratio-Adjusted Summation Index, the RASI Report, courtesy of McClellan Publications. This week, the RASI Index registered 782, well above the 500 mark that denotes Positive market expectations. [more]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes