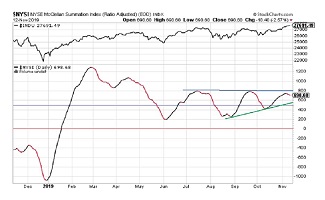

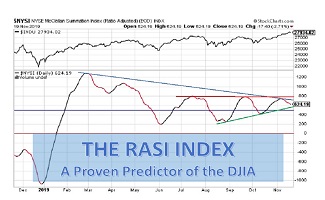

RASI: Index Decline Continues; DJIA Trends Higher

The RASI and the DJIA normally move in unison but, since the beginning of November, the two indexes have moved in opposite directions. While the RASI declined, the DJIA moved into new high ground … until Tuesday, November 19. Is the 100-point down-turn in the DJIA the beginning of a pull-back? [more]