NEW UPDATE REPORT – DATA Communications Management Corp – Strong Operating Controls Offset Revenue Pressure in Q3/2025

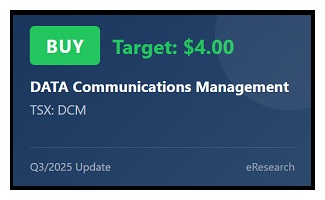

We have written a 20-page Update Report on DATA Communications Management (DCM) after it released its Q3/2025 financials. DCM reported Q3/2025 revenue of $105.4 million, down 3.1% year-over-year, reflecting softer enterprise spending and Canada Post labour disruptions. Despite revenue pressure, operating discipline supported stable profitability, with Adjusted EBITDA of $12.3 million and a 15% reduction in SG&A expenses. Management highlighted growing traction in AI-enabled platforms, including contentcloud.ai and CCM360, with a solid pipeline into 2026. Net Debt was $80.6 million, with over $40 million in liquidity. We maintain our Buy rating but lower our one-year target price to $4.00 from $6.55. [more]