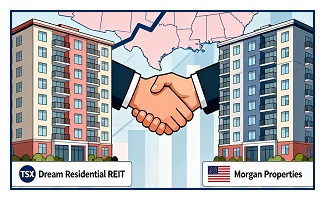

Morgan Properties to Acquire Dream Residential REIT in $354 Million All-Cash Deal

Morgan Properties announced on August 21, 2025, that it will acquire Dream Residential REIT in an all-cash deal valued at US$354 million. The purchase price of $10.80 per unit represents a 60% premium to Dream’s February 19 closing price and 18% above the August 20 price. The transaction adds 3,300 units to Morgan’s portfolio. The deal reflects ongoing consolidation in the multifamily sector as REITs face valuation discounts. Dream’s board unanimously approved the agreement, citing value creation for unitholders. Completion is expected in late 2025, pending approvals. [more]